How to invest in farmland: A beginner's guide to building wealth through agriculture

Thinking of buying farmland? Follow these 5 steps to understand the basics of agricultural land and how to start investing.

Diversifying your investment portfolio can safeguard your financial future.

But if you’re like most investors, the idea of including farmland as an asset class may have felt out of reach.

That’s likely because investing in farmland has historically required an intimate knowledge of the industry, has a substantial upfront cost and is an illiquid market.

However, the landscape is evolving…

New approaches have reduced barriers to entry for this type of agricultural investment, making farmland increasingly accessible to more investors.

Case in point: Consider the burgeoning number of high-profile investors turning their attention to the agriculture sector.

Among them are professional athletes like Cincinnati Bengals’ Joe Burrow, Boston Celtics’ Blake Griffin and Toronto Blue Jays’ Kevin Gausman who — along with around 20 other athletes — invested millions in early 2023 to purchase a 104-acre farm in north Iowa.

Perhaps this surge in farmland investing has you wondering, "What does this mean for an investor like me?”

If so, you’ve come to the right place.

Farming has been in my family for six generations.

And I’ve aided individual investors in the acquisition of $35 million and 2,800 acres of farmland across north-central Iowa.

This makes me uniquely qualified to discuss how to break into farmland investing.

But there's something you won't often hear from other experts…

A successful farm investment isn’t just about recognizing good soil or understanding yield projections.

There are lesser-known “secrets” that set apart a good farmland investment from a great one.

And I’m going to share three of them with you. So, let’s dig into how to invest in farmland.

Step 1. Get clear on “what is farmland investing?”

Investing in farmland isn’t just buying a piece of agricultural land — it’s strategically allocating capital towards an alternative investment class with the intent of generating a return through both rental income and the land’s appreciation.

Let’s begin by looking at the current landscape of farmland ownership.

According to the United States Department of Agriculture (USDA), the U.S. contains nearly 894 million acres of farmland.

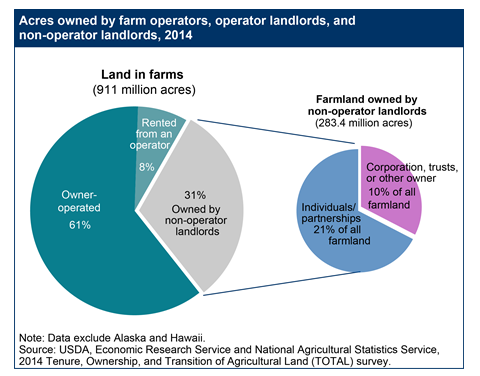

In 2017, the USDA’s Census of Agriculture reported that ~39% of that farmland (about 355 million acres then) was non-owner-operated. This means that it was leased out to farmers who work the land and pay rent.

So, who are these landlords?

About 80% of the leased farmland is owned by non-operator landlords — landowners who aren’t actively involved in farming. Operator landlords (other farm operators) own the remaining 20%.

It's within this context farmland investing becomes particularly attractive.

Despite volatile market conditions, the agricultural investment sector has shown resilience and steady growth, which only emphasizes the long-term stability farmland offers.

This track record underpins the growing recognition of farm land as a viable investment avenue.

Additionally, an emerging group of professional farmers/land managers (like Weiland Farms) has cropped up. These professionals serve as trusted partners, providing the transparency, communication and expertise out-of-state investors need.

Given this landscape, it’s no surprise agricultural land has received a surge of interest — from billionaires to everyday investors.

And if these savvy individuals can seize the opportunity, perhaps you can, too.

Step 2. Evaluate whether farmland is a good investment for you

To fully assess whether agricultural property is a solid investment, it’s important to weigh the distinct advantages, trends and risks the asset class carries.

Here’s how to do that…

Consider the pros and cons of farmland investing

Like any venture, farm land brings its own advantages and challenges. Understanding these can help you make a more informed decision about whether this type of investment aligns with your financial goals and risk tolerance.

Pro: Flexibility in investment approach

Farm land investments offer unique flexibility, allowing you to tailor your risk-reward balance and investment focus to your financial goals.

In terms of risk-reward strategies, you’ve got two main options…

- No risk: Opt for flat or “fixed” lease payments for a more predictable return

- Shared risk: Choose yield and/or price-dependent leases that can bring potentially higher rewards but involve exposure to agricultural risks (weather, market fluctuations, etc.)

You also have two focus areas for capital appreciation:

- Long-term: Focus on the land’s appreciation over time

- Immediate: Prioritize cash returns from leasing

Which of these becomes primary and which is secondary is entirely up to you.

The key thing to remember is that investing in farmland doesn’t mean becoming a farmer.

It means strategically directing your investment.

Pro: Effective inflation hedge

In times of rising prices, farmland can serve as a hedge against inflation. As commodity prices typically increase during inflation, arable land assets tend to also rise in value.

For example…

Inflation soared to a record high of 9.1% in June 2022 compared to the previous year — the fastest pace for inflation since November 1981.

The National Council of Real Estate Investment Fiduciaries’ Farmland Property Index, which tracks the value of investor-owned farm land, increased by 10.2% in 2022.

Meanwhile, the S&P 500 dropped ~20% that same year.

These figures illustrate how strategically incorporating farmland in your portfolio can safeguard your investment.

Con: Limited liquidity

Unlike stocks, bonds and funds that can be bought or sold in a few clicks, farmland is not as liquid an asset.

The National Association of Realtors points out that “selling a farm can take up to three years with all the logistics and family nuances, but most of the listings are completed within four months from the time it comes onto the market to closing day.”

In other words, it can take considerable time to sell your stake and convert it into cash.

Similarly, acquiring farmland can also be a lengthy process. For instance, we've seen the economic landscape shift from under us while we’re hunting for the right parcel.

Con: Steep learning curve

Investing in agricultural land may demand a certain level of understanding and skills, particularly if you opt for a more hands-on approach. This might include understanding the nuances of agricultural operations, land management and market trends.

However, more and more landowners (remember that 80% of non-operator landlords from the USDA survey?) are electing not to be actively involved in farming. Instead, they lease the land to professional farmers and/or hire land managers to run all aspects of day-to-day operations.

Research farmland investing trends

Diving into trends and the historical performance of farmland investments is key to gaining a comprehensive understanding of its landscape.

You’ll want to look at a few key things:

Historical performance

Over the past four decades, we’ve seen a steady appreciation in value and consistent income generation with Iowa farmland. Iowa State University’s Extension and Outreach program newsletter, Ag Decision Maker, reports that nominal farmland values have grown at an annual average rate of 6.7% between 1970 and 2021. With an average annual inflation rate of 4% factored in, that equates to real growth in farmland values at 2.7% per year. Combined with a 6.1% average return from cash rents, the average annual total return on farmland ownership has been 8.8%, inflation-adjusted. This consistency compares favorably with other investment avenues.

Resilience amid economic downturns

Agricultural land has historically been a low-volatility asset. The Journal of the American Society of Farm Managers & Rural Appraisers (ASFMRA) studied the resilience of farmland during the 2008 financial crisis. The study notes that the value of farm land remained relatively stable, experiencing a decline of up to only 11% based on regional variations. The asset class has also stayed relatively stable through periods of market volatility, including the COVID pandemic.

Comparison to traditional asset classes

Farmland has consistently outperformed traditional investments such as real estate, stocks and bonds. MoneyMade.io, an online investing platform that provides market data, analyzed more than 30 years of investing data. The data showed that farmland had a 92% return with an average volatility of 1.38% while being highly correlated to the S&P 500.

Diversification benefits

As a 'hard asset', farmland provides portfolio diversification in that it's not paper-based like stocks, bonds and mutual funds. However, unlike other types of real estate investments like multi-family residential that often require hands-on oversight or costly property management, farmland can provide the exposure of a hard asset with much less intensive management.

Historical risks

Of course, owning cultivated land carries some risks investors need to be aware of. Unpredictability in weather and climate, market and price fluctuations, governmental policies, regulatory risks and other factors can cause wide variability in farm income.

Step 3. Explore your options for how to invest in farmland

You have several options when it comes to investing in farm real estate.

These approaches range from hands-on operations to passive income streams to pooling resources in large-scale investments. Each caters to varying investment styles, knowledge levels and risk tolerances.

Here are the three main investment paths.

Buy the farmland and call all the shots yourself

If you're up for a challenge (and have knowledge and time to spare), you can buy farmland and have it custom-farmed. An alternative to leasing, this hands-on approach gives you complete decision-making control — from selecting the crops to determining when to sell the harvest — without owning and operating the machinery.

In custom farming, you hire professional farmers to run all machine operations. You pay for all seed, fertilizers, pesticides and other necessities, but retain all profits.

Buy the farmland and partner with a farmer

For those looking for a more passive form of investment, the most common approach is purchasing the land and leasing it to a farmer. This model requires less active management since a qualified farmer-tenant handles all aspects of land management and crop production, including planting, harvesting and maintenance. In return, you’ll receive a regular rental income — either via fixed rent or yield-dependent rent — while still allowing your land to appreciate.

However, you’ll need to find a reliable tenant and rental income might be lower than the potential profits you’d see from directly farming the land yourself. This is where it can be helpful to have an experienced partner who can not only provide tenant sourcing and lease agreements but also has a track record of profitable land management.

Buy shares of an existing farm

If you prefer a completely hands-off approach, investing in a farm real estate investment trust (REIT) that specializes in farmland could be a good option. In this model, investors pool their funds to purchase and manage large tracts of cultivated land, sharing profit dividends. REITs offer broad diversification and are accessible to anyone with a brokerage account. However, returns heavily depend on the trust’s management abilities.

Navigating these options might seem daunting, but having the right guidance in sourcing, evaluating and managing farmland is key to a successful investment.

Step 4. Prepare for investing in farmland

Getting ready to buy farmland for investment requires thoughtful groundwork.

This includes comprehending the necessary prerequisites and doing due diligence related to your investment.

Understand the requirements for investing in farmland

Investing in farmland isn’t just about having capital outlay. It takes a wider comprehension of several aspects, including legal and practical implications.

- Capital: Yes, purchasing farm real estate does require a decent amount of upfront capital (typically $500k minimum). The good news is that as it’s a secure collateral choice for lenders, farm acreage can be financed. The amount of capital required typically hinges on the size of the tract you're considering — larger tracts will naturally demand a heftier investment.

- Legal considerations: There can be legal intricacies tied to land ownership, environmental regulations and zoning policies that need to be thoroughly understood before jumping in. These can vary depending on local, state and federal laws, so it can be helpful to engage someone familiar with the region you’re considering.

- Practical knowledge: The level of baseline knowledge required depends on your approach and how hands-on or -off you plan to be. This can range from understanding basic land management principles to having in-depth knowledge of agriculture market dynamics.

Engaging with an experienced professional can guide you through each step, ensuring you’re well-equipped to make informed decisions.

Consider other vital factors

There are several other factors you’ll want to consider while preparing to purchase agricultural property.

Some of these criteria are often overlooked — which can make or break the success of your investment.

Location

Critical aspects like natural soil fertility, water availability and climate will significantly determine the potential productivity of your land. That means you’ll want to dive deep into local geographical data around soil absorption, average rainfall and watershed characteristics.

Historical imagery analysis

This brings us to the first “secret” many land buyers overlook. By reviewing localized imagery from prior years, you can gain insights into how the farm has performed during various climate conditions (dry years, wet years, etc.) This analysis can provide valuable information about the land’s resilience and suitability for specific crops.

Technology capabilities

How well-suited is the property for modern farming technologies? Leveraging agricultural innovation can drastically boost your farm’s productivity and efficiency. Therefore, you’ll want to understand the farm's access to precision farming tools, automation, cropping adaptation and advanced equipment.

Sustainability

Sustainability practices are pivotal in preserving the long-term health and productivity of the land. Seek farms (and tenants, if you’re looking to lease) that prioritize sustainable pest management practices, water conservation and soil preservation techniques.

Crop diversification

Crop diversification is one approach that can set your investment strategy apart. Having the ability to cultivate a variety of crops rather than solely relying on one type of crop can mitigate risk and potentially boost your returns.

However, this is another “secret” many farms tend not to emphasize…

That’s because choosing the right crops — the ones that will thrive — requires an intimate understanding of each tract of land’s unique potential.

Making these informed decisions isn't just about the land's characteristics though.

It's also about market trends and consumer preferences. This is where strategies like growing identity-preserved crops (IP crops) come into play.

These types of crops, which we specialize in at Weiland Farms, cater to niche customers who value unique characteristics and are willing to pay premium prices for distinctive products.

Length of investment opportunity

Remember, farm real estate investing is typically a long game — so patience is key. Your first return on investment might take years to materialize, so make sure you’re comfortable with committing for the long haul.

Step 5. Partner with an experienced professional

Considering the complexities associated with purchasing farmland, finding the right partner can streamline the investment process.

Your potential partner should be able to guide you through sourcing and evaluating potential land, navigating the acquisition process and managing your land post-purchase.

This brings us to the third secret.

Many entities might focus on just the buying process, which is important.

But acquiring your land is only the first step…

The most crucial part of your investment strategy comes with managing your land, optimizing its productivity and maintaining its inherent value for the long run.

This is where having a shared business partner's expertise and holistic service offering can truly make a difference.

At Weiland Farms, we offer support at every stage of the farmland investment process, from vetting property to assisting in purchase transactions to providing post-purchase land management services for income generation.

Whomever you decide to partner with, make sure they're equipped to support your entire investment journey beyond acquisition.

The bottom line

Investing in farmland isn’t just about purchasing a plot of land.

It's about securing an asset with strong growth potential, stable returns and low volatility.

So, if you're a long-term investor who’s looking to diversify, agricultural land might be a smart addition to your portfolio.

Buying farm real estate is a nuanced process. It requires strategic decision-making and, ideally, the guidance of an experienced partner. If you’re interested in investing in farmland in north-central Iowa, learn more about how Weiland Farms can support your journey.

Reid Weiland is the managing partner of Weiland Farms. He oversees the farm’s day-to-day operations and leads all land management and farmland acquisition efforts.

Disclaimer: This article is for general informational purposes only and does not constitute investment, financial or tax advice. You should consult with a licensed professional for advice concerning your specific situation.

.svg)